As your nonprofit begins to prepare its taxes, it is also a good time to conduct a fundraising audit. A fundraising audit, will aide in developing a data-driven strategy to help your organization and fundraising efforts expand and grow. Below is a list of what to include in your fundraising audit and what to keep in mind for this year. Strategic Insights: Measuring Fundraiser ROI. Optimize campaigns, analyze impact, and boost fundraising effectiveness for sustained nonprofit success.

Measuring Fundraiser ROI

Recapping each campaign of in the last year or last fiscal year should include the following information to help determine what worked and what needs improvement:

- Name of campaign

- Type of campaign

- Purpose of the fundraiser

- Messages used such as social media posts, emails, images, website banners, flyers etc.

- Date/time of fundraiser

- Response monetarily as well as attendance levels if there was an event involved

- Any other ways that would measure the success of campaign i.e. feedback, comments, gifts collected

- Expenses involved

- Ratio of new donors to existing donors to see what captured new audiences

- Also, include the number of new potential donors. For example, new newsletters subscribers.

All of this information can then be broken down even further to measure what worked and what needs improvement. The more statistical data you can measure the better your fundraising efforts will be for next year.

Measuring Donor Levels

The campaign overview will help you visualize campaign successes, as well as donor retention. Measuring donor retention as well as those who consistently give larger amounts will help you target the right audiences for future campaigns.

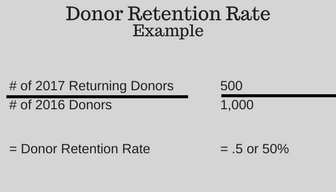

Donor retention is the number of donors who continue to give to your nonprofit organization each year. To measure donor retention, take the number of donors from last year and divide by the number of donors from the previous year.

If you have done a fundraising audit in the past or have a list of donors from previous years you can compare information to see which donors have given consistently and those that are new and have returned to give each year.In the above example, Year 2017 recognized half of returning donors from the previous year. All other factors being the same, this retention rate indicates a need to increase donor communication and keep them connected to your cause.

As a new fundraising year begins, it is important to complete a fundraising audit. Preparing this information will not only help your development efforts and Board of Directors but also be useful in your nonprofit’s annual audit.

Ernst Wintter & Associates LLP specialize in California non-profit audits and tax preparation. Contact us today for help with your non-profit audit or tax prep needs.